Our Contacts

70 Santa Felicia Dr

Goleta, CA 93117

2243 S. Depot Street, Suite 101

Santa Maria, CA 93455

Our Contacts

70 Santa Felicia Dr

Goleta, CA 93117

2243 S. Depot Street, Suite 101

Santa Maria, CA 93455

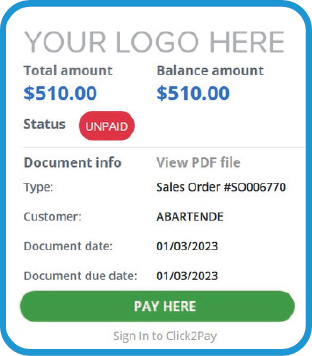

Click2Pay works as a complete customer portal -or- as a method for fast pay using anonymous links.

Seamless connecting with your ERP, Click2Pay offers dynamic, real-time invoicing and sales support. It includes bi-directional communication between the ERP and the payment portal, allowing for real-time updates to transactions as needed.

Click2Pay provides your customers with anonymous, one-time-use payment links; no logins or passwords required. This provides them with a faster and more secure payment process without providing Credit Card or ACH information to the merchant.

A merchant-enabled Customer Portal is also available to give customers even more control over their payment processing. The Customer Portal includes:

Innovation never ends! New features on the horizon include:

Reduce Credit Card Processing fees. Get the best rate with Paya’s Sage 100 level 3 integration.

Capture the specific line item data integrated from Sage 100 in credit card transactions.

These additional fields are required by VISA and Mastercard to achieve Level 3 credit card processing savings:

Prevent fraud with EMV chip technology. Once commonplace, counterfeit fraud — in which a cardholder’s information is collected, stored and reprinted on a different card — has declined sharply since EMV chip technology began to appear.

When you make a purchase via EMV card, the merchant never receives or transmits your actual card number. That makes it much more difficult for malicious actors to counterfeit your card.

Paya’s Sage 100 integration adheres to PCI DSS requirements.

With Paya’s Sage 100 credit processing solution, you can safely and securely accept, store, process, and transmit cardholder data during credit card transactions, to prevent fraud and theft.

Please fill out the form below and one of our knowledgeable finance and accounting representatives will get back to you.